Do you remember when the Fed was desperately seeking to boost inflation to a ‘healthy norm’ of 2%? Achieving that goal was Janet Yellen’s mission for years. Thanks to a confluence of factors—including money printing, deficit spending, global supply chain disruptions, and a post-pandemic consumer buying frenzy (even if the pandemic appears to be far from over)—that goal has finally been achieved. Inflation has officially taken off. Instead of the Fed fretting over how to battle extremely low inflation with interest rate reductions and other strategies, all eyes are now on how to rein in inflation which many fear is poised to spiral out of control. For investors, that shift begs the question: ‘How does inflation impact my portfolio?’ And more importantly: ‘Do I need to adjust my investment strategy to address the current environment?’

Before we dive in to the impact of inflation on your portfolio and your strategy moving forward, let’s take a brief look at inflation basics:

A healthy economy and moderate inflation are good for investors, largely because this means the companies you are invested in are growing. The problem comes when inflation is sustained over a long period of time.

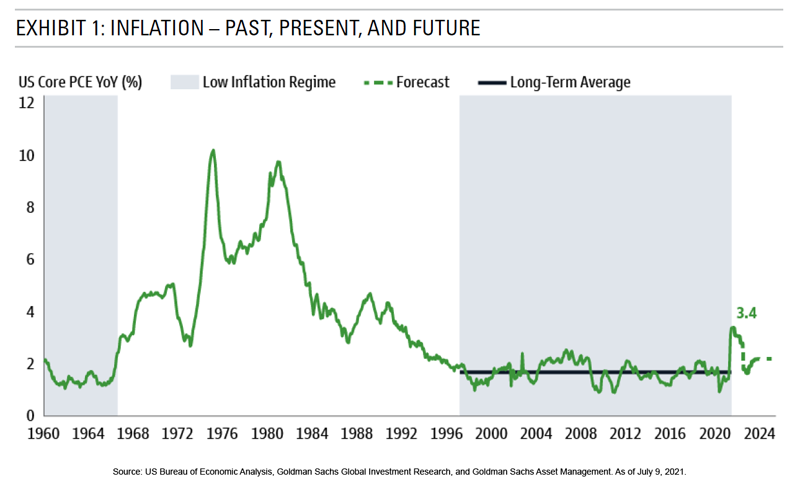

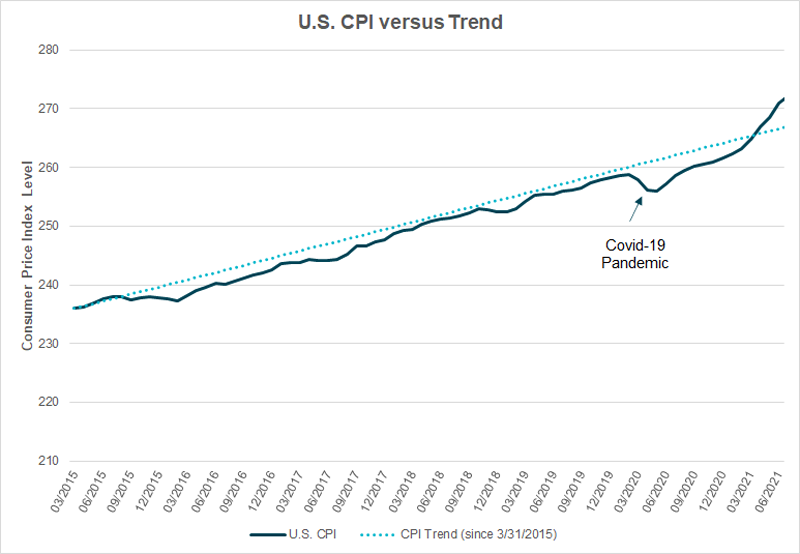

Unfortunately, if sustained, rising inflation can be problematic for investors. According to this recent article in Forbes, “the classic 60/40 stock/bond portfolio may get hit from both sides, as prices rise both stocks and bonds can fall in price. In fact, a 60/40 strategy has historically returned around 9% a year, but closer to 2% during high inflation.” It is important to remember, however, that the CPI fell dramatically in 2020 due to the pandemic. As illustrated above, the pickup in inflation has simply brought inflation back to the trend line.[1]

While inflation is commonly considered bad news for stocks, this is usually true only in the short term. Over the long term, stocks can be strong inflation hedges, and allocating to stocks often generates returns that exceed the pace of inflation. On another positive note, in many previous periods of high inflation, the market fluctuated in response to the Fed’s reaction (or expected reaction) to inflation with changes in interest rates. This time around, the Fed is openly communicating its willingness to be patient with inflation rather than acting too quickly in an attempt to achieve the target long-term rate of 2%. But the Fed is not sitting idle. At the July Federal Reserve Meeting, plans were made to pull back monthly bond purchases, likely before the end of the year. Will that tapering be enough to make a difference? Will the Fed be too patient and allow price levels to jump too high? Will such a jump demand a sharp rise in interest rates? Only the future will tell.

From our perspective, we expect the recent inflation figures to have very little impact on most investors’ investment strategies and allocations. We strongly believe that the best protection against inflation is a well-diversified portfolio. That said, we have no crystal ball and, like the Fed, we aren’t sitting idle. We are keeping our eyes on the numbers, analyzing long-term inflation projections, and adjusting our portfolios as necessary to help preserve your purchasing power, your portfolio, and your long-term wealth.

Still concerned about the potential risk of inflation? Please call or email us to schedule a conversation.

[1] While inflation is often quoted in a year-over-year growth rate, this graph illustrates the absolute price level to illustrate the point. The trend line is estimated by regressing the preceding 5 years of CPI data before the Covid-19 pandemic.