2023 market review and outlook

At the start of each new year, it’s always wise to look in the rearview mirror to understand how we got where we are today and, importantly, where the economy, markets, and all things financial may be headed in the coming year. Considering the dire predictions from economists who, early last year, shared the near-unanimous outlook that a recession was inevitable, 2023 could well be dubbed ‘the year of surprises.’ Not only did a recession fail to land (hard, soft, or otherwise), but both the economy and the stock market surpassed even pre-pandemic forecasts.

In retrospect, what is clear now is a textbook example of the adage ‘bend but don’t break’—particularly in the context of Wall Street’s performance and economic resilience. Here are just a few of the factors that defined 2023:

- Wall Street’s consensus missed the mark—yet again

In January 2023, Wall Street braced for a recession in the first half of the year. However, the S&P 500’s staggering +26.3% total return in 2023 contradicted these gloomy forecasts. This performance is even more impressive considering the flat year-over-year operating earnings and the 120 basis points increase in 10-year yields over the first 10 months. December contributed to this trend, with a 4% rise in stocks while bond yields fell. Even with the sharp rise in rates, bonds managed to post a positive year, ending at +2.5% for the Bloomberg Barclays US Aggregate fixed income benchmark.

- The Fed & Treasury ignited a year-end rally

A pivotal moment occurred on October 27, when the S&P 500 was languishing around 4,100, and the 10-year U.S. Treasury yield stood at 4.83%. What followed in the next ten weeks was a rally that drove up the S&P 500 +17%, while the 10-year Treasury yield fell by more than 90 basis points, ending the year at 3.88%. Two significant factors contributed to this turnaround. First, the Treasury Department’s decision to issue more short-term debt created a scarcity at the longer end of the yield curve, which resulted in more demand and lower yields for long bonds. Second was Federal Reserve Chairman Powell’s declaration of victory over inflation in mid-December—welcome words that led to a pause in rate hikes and a pivot to a less restrictive monetary policy. (Finally!)

- The ’Magnificent Seven’ monetized the AI revolution

No discussion of 2023 would be complete without mentioning the impact of generative artificial intelligence (GenAI) on business and society. Businesses everywhere jumped on the GenAI opportunity, using this powerful tool to enhance efficiency, innovate product development, and personalize customer experiences. GenAI also had a marked impact on society as a whole, facilitating advancements in healthcare, education, and entertainment, and profoundly influencing how people interact, learn, and consume content. (It also raised important discussions about ethics, privacy, and the future of employment, though that is a different discussion for a different day!)

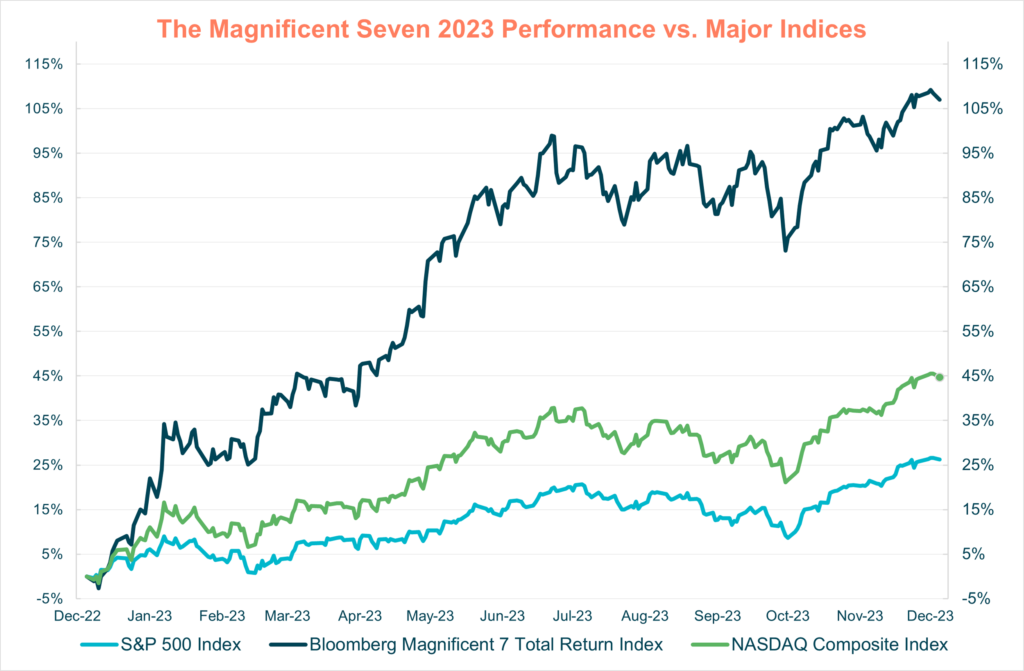

From an investment perspective, GenAI resulted in the rise of the ‘Magnificent Seven’—a group of seven of the largest companies known for their strong positions in artificial intelligence and other cutting-edge technologies that dominated the market for most of the year. On that impressive roster: Apple, Microsoft, Alphabet (Google’s mother ship), Amazon, Meta (formerly known as Facebook), Nvidia, and Tesla. In total, these seven stocks alone jumped an incredible 107% in 2023, accounting for nearly 75% of the S&P 500’s 26.3% return for the year. Though these stocks are likely to continue to dominate for the foreseeable future, the broadening market trend that emerged late in the year shone a positive light on ‘the rest’ of the market, with the equal-weight S&P 500 rising +16.6% from October 31 to December 31, indicating the potential longevity of the current bull market.

Source: Bloomberg L.P.

- The anticipated ‘hard landing’ never happened

Despite a storm of economic, geopolitical, and interest rate shocks, the US economy showed a level of resilience that was nothing short of remarkable. Despite daunting inflation rates, the NFIB’s small business optimism survey remained impressive. At the same time, a better-balanced labor market saw businesses cutting job openings rather than jobs (a key to anchoring inflation) as well as a solid rise in US payrolls in December, accompanied by a steady unemployment rate and a significant yearly increase in average hourly earnings.

What lies ahead?

While the US economy shows only rolling weakness compared to more significant global economic challenges, we do see the potential for downward pressures in the first half of 2024. From an investment perspective, the greatest risk in 2024 will likely be whether a second wave of inflation can be avoided. Other factors that may impact the market: monetary policy and interest rates (especially if a second wave of inflation does rear its ugly head), investor tension leading up to the November presidential election, escalating conflicts abroad, and more market shifts driven by AI and other technology advancements.

Our focus, always, is to apply strategies to both grow and protect your assets—in every market environment. The significant rally in the S&P 500, despite flat earnings, points to the power of market sentiment and macroeconomic policies to significantly influence market movements, sometimes even more than fundamental financial metrics. The performance of tech stocks, especially the ‘Magnificent Seven,’ highlights the need to stay abreast of technological trends and their potential market impacts. The resilience and unpredictability that was evident in 2023 underscore the value of our adaptive strategies, informed decision-making, and ability to look beyond conventional wisdom to navigate the complex financial landscape effectively. We look forward to sailing forward together in 2024—no matter what surprises the world may throw our way!

← Back to Insights

Principal & Senior Investment Officer