With the school year well under way, it seems like an appropriate time to do some academic thinking about the current market, the economy, and how it impacts our strategies at LCM—and the strength of your portfolio. Though you’ve likely seen the headlines on all of the above, taking a closer look at the details can add some important perspective that may give you peace of mind and help smooth any potential storms that lie ahead.

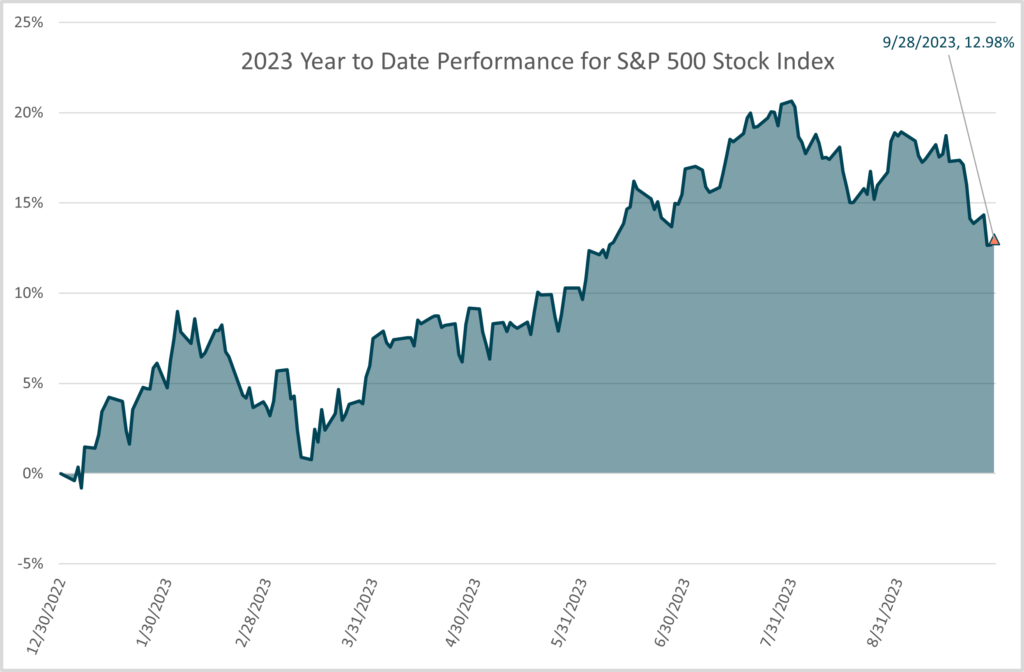

When 2023 began, there was little to be optimistic about. My December blog post, Riding out the turbulence, paints the rather dismal picture. At the time, inflation was running high, the Fed’s aggressive monetary policy was pushing up interest rates in an effort to shock the system, and a potential recession was on everyone’s minds. To most everyone’s surprise, the first half of the year proved to be much better than anticipated. Despite some major hurdles that included the regional banking debacle in March, debt ceiling fears, and noisy inflation data (which gave investors less clarity on the path of interest rates), the S&P 500 has maintained an impressively upward trend. Despite dipping from its peak at the end of July, the index is still up almost 13% for the year (through 9/28/2023).

Source: Bloomberg

While it’s risky business to try to assess exactly why the market and the economy have proven so resilient, it’s clear that investor optimism is one driving force. Early on, enthusiasm around AI played a big role, helping to drive a market rally that extended beyond the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) to a longer list of companies that fuel the AI supply chain. At the same time, despite very low earnings expectations across the board, corporate earnings consistently surprised to the upside. Two other welcome surprises: unemployment didn’t spike, and consumer spending didn’t collapse—further supporting the unexpectedly resilient corporate earnings.

Of course, every experienced investor knows that the past is not always predictive of the future. As we head into the final quarter of 2023, there are several factors in play that are likely to impact whether more happy surprises are headed our way—or not. Here they are in a nutshell:

So, inflation is slowing and the economy is staying strong. Why isn’t the market celebrating? At the moment, the news is not quite that simple. On the bright side, the Fed changed several forecasts in their Summary of Economic Projections, forecasting inflation down for 2023 and 2024 (hooray!), and forecasting the GDP up for 2024 and 2025 (hooray again!). But this also means that inflation pressures (the things that typically push up prices for goods and services—will likely increase). This would force the Fed to keep policy interest rates elevated for longer than they had originally planned, and that could mean we are finally heading into the long-awaited recession.

Even that is far less than clear. The Fed now views the risk of recession as lower than during previous meetings. The Fed is aiming for a ‘soft landing’ in which inflation is eventually brought down to target without causing recession. Market participants initially viewed this scenario as quite unlikely, but the odds have increased given the continued downwards trajectory of inflation and the resilient economy. The risk of a deep recession looks much less likely—at least in the absence of any new and unexpected market shock. Instead, perhaps the more likely scenario is a mild recession that sees inflation gently settling down to target, the labor market coming into balance, and wage inflation gradually slowing. A ‘no-landing’ scenario is also possible. In this case, inflation would remain elevated, yet the economy would grind higher, and the Fed would likely have to rethink its policy rate approach. However, because the US economy is largely service based, and because services inflation has not come down as much as goods inflation, the likelihood of inflation just disappearing on its own is slim to none.

Remember, however, that recessions are part of a normal market cycle. History shows that when the Fed raises interest rates aggressively, recession usually follows. History also shows that the Fed’s track record of avoiding recession is not great. One reason is that the data that drives policy decisions is both ‘noisy’ and lagging. This makes it very difficult to have confidence that a correction has been reached until long after the fact. Once the data demonstrates success, the policy has likely been in place too long, causing an overcorrection and, ultimately, a recession.

From an investment perspective, recessions bring the benefit of lower asset prices that offer long-term investors buying opportunities at discounted valuations, leading to potentially substantial gains when the market recovers. And just as we saw during the pandemic, trying times can force companies to streamline operations and become more efficient, potentially leading to stronger business performance and better investment prospects post-recession. The final silver lining for businesses and consumers alike is that a recession is almost certain to drive down interest rates, reducing borrowing costs and spurring growth, both of which can benefit investors as the economy rebounds. In my opinion, if the only punishment we get for years of low interest rates and market acceleration is a mild recession, I’ll happily take it!

No matter what scenario comes to be, our portfolios are designed for resilience to continue to grow and protect your assets. While our strategies are not reactionary to short-term market changes, they are flexible, giving us the freedom to make necessary adjustments as the landscape shifts. Here are a few things that are impacting our decisions today:

That said, our faith in the power of the market remains strong. Our approach, always, is to carefully navigate the current landscape by ‘trimming the sails’ of our portfolios. Rather than making any dramatic changes to our strategies, we make small adjustments designed to weaken the impact of market downturns and to take advantage of investment opportunities as they arise. Every action we take is based on extensive research and our years of experience as trusted investment advisors.

Wherever the wind takes us in 2023, this market cycle will play out—eventually. Inflation will settle. Interest rates will come down. The market will become less volatile and more predictable. Until that happens, know that your portfolio is designed to withstand any storm.