Did you catch this article in the LA Times Image magazine (cleverly titled ‘Carpet diem’ in the print version!)? The topic: the unlikely return of a once-despised design element: wall-to-wall carpet. Surprised? Probably not. The endless cycle of trends is a fact of life in the modern world. From wide-leg jeans and short hairstyles to classic cocktails and carpets, there aren’t many things that don’t make a comeback, sometimes over and over again. While this cycle of design and lifestyle trends may not have much impact on your financial life, market trends most certainly do. In today’s topsy-turvy market, understanding market trends is particularly important as we strive to grow and protect your assets. To put these trends to task in our portfolios, we use an alternative asset class called Managed Futures.

What are Managed Futures?

A lesser-known tool for portfolio diversification, Managed Futures are alternative investments that consist of a portfolio of futures contracts. Used primarily by large funds and institutional investors, this asset class is unique in that it is often weakly or inversely correlated with the stock and bond markets, both of which have turned down significantly in recent months. In this environment, Managed Futures can be very helpful in balancing risk and reward within our portfolios.

If you’re more familiar with traditional strategies, investing in alternatives like Managed Futures might make you feel like you’re walking on shaky ground. (After all, who could have predicted that carpet would make a comeback?) When trends can seem completely unpredictable, why do we feel confident that market trends really exist or, more importantly, that this strategy can help us profit from them? The answer is twofold.

Though Managed Futures can be used in multiple ways, here at LCM, we use Managed Futures funds as part of our multi-strategy portfolio, which helps improve risk-adjusted return when combined with our traditional Growth and Income strategies. So far in 2022, this approach has proven to be worth the effort. The SG Trend Index, an index that tracks the performance of trend-following Managed Futures strategies, was up 25.99% for the year as of April 30. That’s a sharp contrast to the performance of many traditional asset classes which were consistently down over the same time period, with stocks (the S&P 500) dropping -12.92% and bonds (Bloomberg Barclays US Aggregate) falling -9.50%.

The power of trends

The strength of Managed Futures comes from their ability to identify and follow positive or negative trends in asset prices. This is achieved by evaluating trends in performance over multiple time horizons. Empirical research is used to support the fund managers’ algorithms that decide when to purchase (go long), when to sell short, and when to exit either a long or short position.

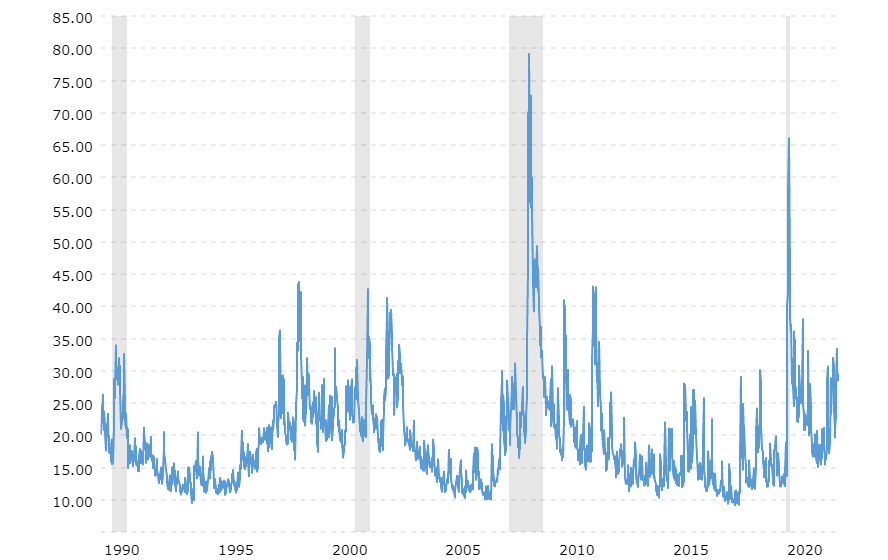

The Volatility Index (VIX), which measures when the broad market experiences unpredictable or extreme price movement, illustrates how trends can be used to work in our favor. Volatility began to escalate from a decade-long low at the start of the pandemic. As you can see here, the initial jump was significant, as was the trend that followed:

VIX Volatility Index: 1990-2022

Source: macrotrends

In this era of high volatility, the correlation between equities and bonds has risen (meaning the two asset classes are moving in the same direction), and both are being punished. This close correlation erodes the diversification benefit of traditional portfolios that strategically balance stocks and bonds. In this case and others like it, Managed Futures funds can adjust their investment position from bullish (or long) toward equities and/or fixed income, to bearish (or short) toward either asset class. Beyond just equities and fixed income, trends also exist in other financial markets like commodity futures and currency futures. At LCM, we use funds with diversified strategies in multiple asset classes to help ensure that the performance of a fund is not driven entirely by a single trend. This strategy stands to benefit our portfolios at a time when volatility and panic are strong forces in a market.

Managed Futures is, of course, just one piece of our multi-strategy portfolio which is designed to smooth portfolio performance and improve risk-adjusted returns. That said, it has played an important role in helping to protect our clients’ assets by providing ‘crisis alpha’ during events that have had a negative impact on the broader market, including the China/US trade tensions at the end of 2018 and the start of the pandemic in 2020. While we can all hope that certain trends never make a comeback (mullet haircuts and leg warmers!), the trends we watch in the market follow relatively predictable cycles. When they do return, our approach to Managed Futures is poised to help deliver the growth you seek year after year.