As the market attempts to sustain the fever pitch of 2019 into the new year, a deadly epidemic has struck across the globe threatening to put a halt to the seemingly secular growth we have become accustomed to in the United States. The Coronavirus, which originated in Wuhan, China, has now spread to over 15 countries, with 9,700+ confirmed cases and over 210 deaths at the time of this writing. Over 50 million Chinese citizens have been placed under lockdown, while most countries worldwide have halted flights into China. The market’s reaction? Erasing U.S equity gains for the year, finishing the month at (-0.04%), its worst January since 2016.

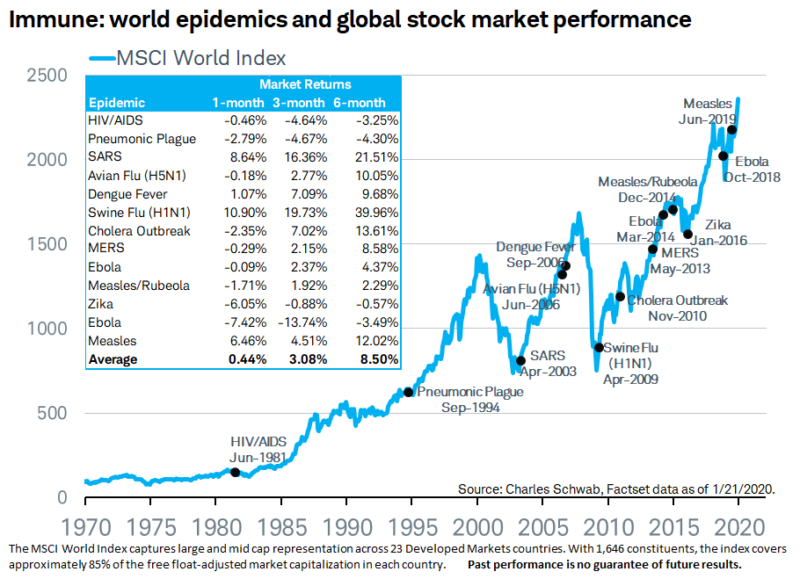

This piqued our interest– how have global markets reacted to outbreaks in the past? As you can see from the chart above, history tells us that on average, markets are able to shake off the effects of an epidemic. Though there is always the possibility of a black swan event, markets tend to be unfazed by epidemic outbreaks.

This specific outbreak is especially dangerous as it comes during Lunar New Year, when Asia sees increased travel. Hong Kong has implemented travel restrictions from mainland China into the region in an attempt to control the spread of the virus. We continue to monitor the long-term effects of this outbreak on the supply chain of companies who house major operations in China.

While we are monitoring the developments of the Coronavirus, we remain wary of political risk involving the impeachment trial, Brexit, and economic risk as this bull market stampedes on to its 11th year later this quarter. We remain steadfast investors, deploying capital in our clients’ best interests. If you have any questions about your portfolio or current economic conditions, please reach out to us at your convenience.